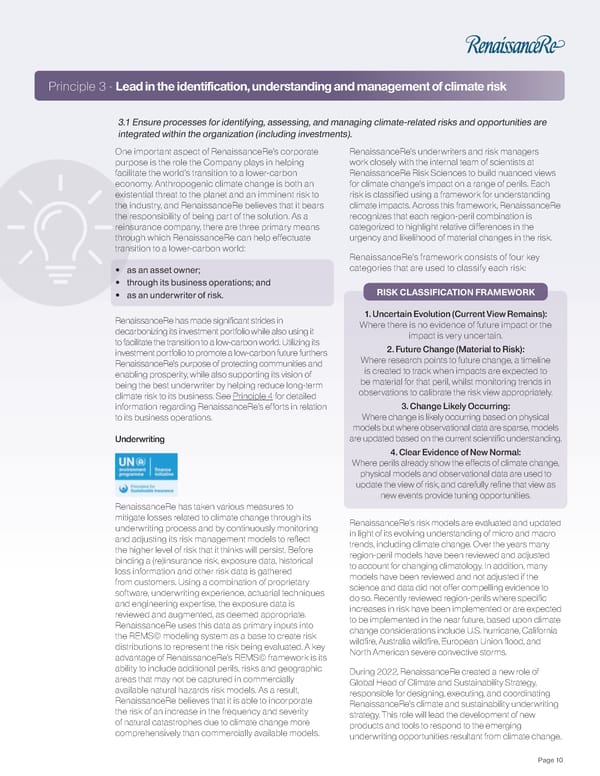

Principle 3 - Lead in the identification, understanding and management of climate risk 3.1 Ensure processes for identifying, assessing, and managing climate-related risks and opportunities are integrated within the organization (including investments). One important aspect of RenaissanceRe’s corporate RenaissanceRe’s underwriters and risk managers purpose is the role the Company plays in helping work closely with the internal team of scientists at facilitate the world’s transition to a lower-carbon RenaissanceRe Risk Sciences to build nuanced views economy. Anthropogenic climate change is both an for climate change’s impact on a range of perils. Each existential threat to the planet and an imminent risk to risk is classified using a framework for understanding the industry, and RenaissanceRe believes that it bears climate impacts. Across this framework, RenaissanceRe the responsibility of being part of the solution. As a recognizes that each region-peril combination is reinsurance company, there are three primary means categorized to highlight relative differences in the through which RenaissanceRe can help effectuate urgency and likelihood of material changes in the risk. transition to a lower-carbon world: RenaissanceRe’s framework consists of four key • as an asset owner; categories that are used to classify each risk: • through its business operations; and • as an underwriter of risk. RISK CLASSIFICATION FRAMEWORK 1. Uncertain Evolution (Current View Remains): RenaissanceRe has made significant strides in Where there is no evidence of future impact or the decarbonizing its investment portfolio while also using it impact is very uncertain. to facilitate the transition to a low-carbon world. Utilizing its 2. Future Change (Material to Risk): investment portfolio to promote a low-carbon future furthers Where research points to future change, a timeline RenaissanceRe’s purpose of protecting communities and is created to track when impacts are expected to enabling prosperity, while also supporting its vision of be material for that peril, whilst monitoring trends in being the best underwriter by helping reduce long-term observations to calibrate the risk view appropriately. climate risk to its business. See Principle 4 for detailed information regarding RenaissanceRe’s efforts in relation 3. Change Likely Occurring: to its business operations. Where change is likely occurring based on physical models but where observational data are sparse, models Underwriting are updated based on the current scientific understanding. 4. Clear Evidence of New Normal: Where perils already show the effects of climate change, physical models and observational data are used to update the view of risk, and carefully refine that view as new events provide tuning opportunities. RenaissanceRe has taken various measures to mitigate losses related to climate change through its RenaissanceRe’s risk models are evaluated and updated underwriting process and by continuously monitoring in light of its evolving understanding of micro and macro and adjusting its risk management models to reflect trends, including climate change. Over the years many the higher level of risk that it thinks will persist. Before region-peril models have been reviewed and adjusted binding a (re)insurance risk, exposure data, historical to account for changing climatology. In addition, many loss information and other risk data is gathered models have been reviewed and not adjusted if the from customers. Using a combination of proprietary science and data did not offer compelling evidence to software, underwriting experience, actuarial techniques do so. Recently reviewed region-perils where specific and engineering expertise, the exposure data is increases in risk have been implemented or are expected reviewed and augmented, as deemed appropriate. to be implemented in the near future, based upon climate RenaissanceRe uses this data as primary inputs into change considerations include U.S. hurricane, California the REMS© modeling system as a base to create risk wildfire, Australia wildfire, European Union flood, and distributions to represent the risk being evaluated. A key North American severe convective storms. advantage of RenaissanceRe’s REMS© framework is its ability to include additional perils, risks and geographic During 2022, RenaissanceRe created a new role of areas that may not be captured in commercially Global Head of Climate and Sustainability Strategy, available natural hazards risk models. As a result, responsible for designing, executing, and coordinating RenaissanceRe believes that it is able to incorporate RenaissanceRe’s climate and sustainability underwriting the risk of an increase in the frequency and severity strategy. This role will lead the development of new of natural catastrophes due to climate change more products and tools to respond to the emerging comprehensively than commercially available models. underwriting opportunities resultant from climate change. Page 10

2022 ClimateWise Report Page 11 Page 13

2022 ClimateWise Report Page 11 Page 13