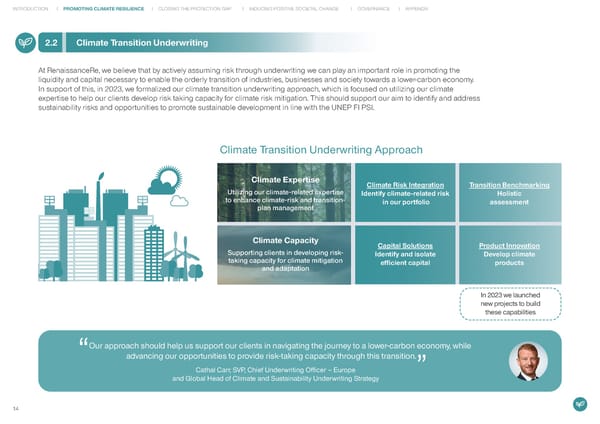

INTRODUCTION PROMOTING CLIMATE RESILIENCE CLOSING THE PROTECTION GAP INDUCING POSITIVE SOCIETAL CHANGE GOVERNANCE APPENDIX 2.2 Climate Transition Underwriting At RenaissanceRe, we believe that by actively assuming risk through underwriting we can play an important role in promoting the liquidity and capital necessary to enable the orderly transition of industries, businesses and society towards a lower-carbon economy. In support of this, in 2023, we formalized our climate transition underwriting approach, which is focused on utilizing our climate expertise to help our clients develop risk taking capacity for climate risk mitigation. This should support our aim to identify and address sustainability risks and opportunities to promote sustainable development in line with the UNEP FI PSI. Climate Transition Underwriting Approach Climate Expertise Climate Risk Integration Transition Benchmarking Utilizing our climate-related expertise Identify climate-related risk Holistic to enhance climate-risk and transition- in our portfolio assessment plan management Climate Capacity Capital Solutions Product Innovation Supporting clients in developing risk- Identify and isolate Develop climate taking capacity for climate mitigation efficient capital products and adaptation In 2023 we launched new projects to build these capabilities Our approach should help us support our clients in navigating the journey to a lower-carbon economy, while advancing our opportunities to provide risk-taking capacity through this transition. Cathal Carr, SVP, Chief Underwriting Officer – Europe and Global Head of Climate and Sustainability Underwriting Strategy 14

RenaissanceRe Sustainability Report 2022 Page 14 Page 16

RenaissanceRe Sustainability Report 2022 Page 14 Page 16