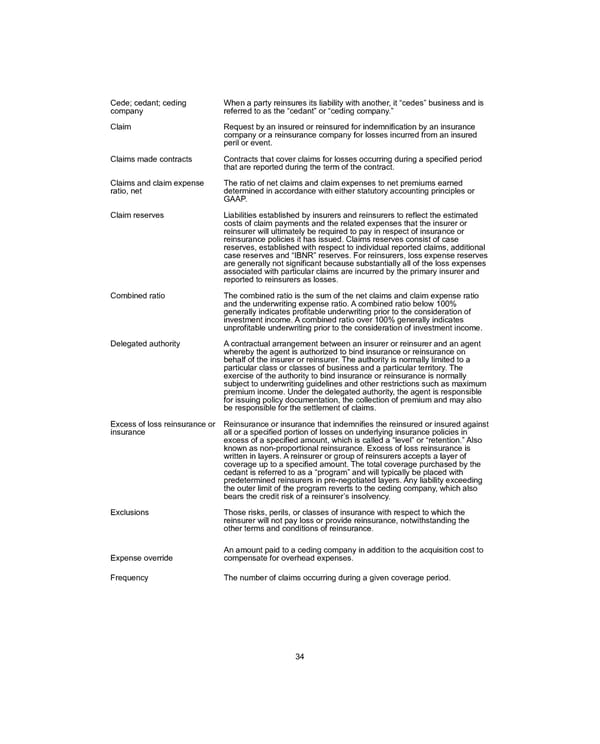

Cede; cedant; ceding company When a party reinsures its liability with another, it “cedes” business and is referred to as the “cedant” or “ceding company.” Claim Request by an insured or reinsured for indemnification by an insurance company or a reinsurance company for losses incurred from an insured peril or event. Claims made contracts Contracts that cover claims for losses occurring during a specified period that are reported during the term of the contract. Claims and claim expense ratio, net The ratio of net claims and claim expenses to net premiums earned determined in accordance with either statutory accounting principles or GAAP. Claim reserves Liabilities established by insurers and reinsurers to reflect the estimated costs of claim payments and the related expenses that the insurer or reinsurer will ultimately be required to pay in respect of insurance or reinsurance policies it has issued. Claims reserves consist of case reserves, established with respect to individual reported claims, additional case reserves and “IBNR” reserves. For reinsurers, loss expense reserves are generally not significant because substantially all of the loss expenses associated with particular claims are incurred by the primary insurer and reported to reinsurers as losses. Combined ratio The combined ratio is the sum of the net claims and claim expense ratio and the underwriting expense ratio. A combined ratio below 100% generally indicates profitable underwriting prior to the consideration of investment income. A combined ratio over 100% generally indicates unprofitable underwriting prior to the consideration of investment income. Delegated authority A contractual arrangement between an insurer or reinsurer and an agent whereby the agent is authorized to bind insurance or reinsurance on behalf of the insurer or reinsurer. The authority is normally limited to a particular class or classes of business and a particular territory. The exercise of the authority to bind insurance or reinsurance is normally subject to underwriting guidelines and other restrictions such as maximum premium income. Under the delegated authority, the agent is responsible for issuing policy documentation, the collection of premium and may also be responsible for the settlement of claims. Excess of loss reinsurance or insurance Reinsurance or insurance that indemnifies the reinsured or insured against all or a specified portion of losses on underlying insurance policies in excess of a specified amount, which is called a “level” or “retention.” Also known as non-proportional reinsurance. Excess of loss reinsurance is written in layers. A reinsurer or group of reinsurers accepts a layer of coverage up to a specified amount. The total coverage purchased by the cedant is referred to as a “program” and will typically be placed with predetermined reinsurers in pre-negotiated layers. Any liability exceeding the outer limit of the program reverts to the ceding company, which also bears the credit risk of a reinsurer’s insolvency. Exclusions Those risks, perils, or classes of insurance with respect to which the reinsurer will not pay loss or provide reinsurance, notwithstanding the other terms and conditions of reinsurance. Expense override An amount paid to a ceding company in addition to the acquisition cost to compensate for overhead expenses. Frequency The number of claims occurring during a given coverage period. 34

2021 Annual Report Page 49 Page 51

2021 Annual Report Page 49 Page 51