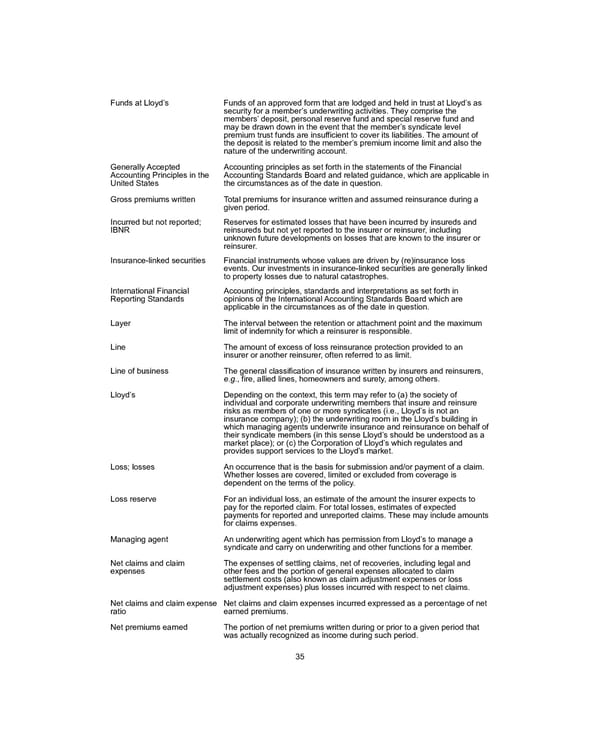

Funds at Lloyd’s Funds of an approved form that are lodged and held in trust at Lloyd’s as security for a member’s underwriting activities. They comprise the members’ deposit, personal reserve fund and special reserve fund and may be drawn down in the event that the member’s syndicate level premium trust funds are insufficient to cover its liabilities. The amount of the deposit is related to the member’s premium income limit and also the nature of the underwriting account. Generally Accepted Accounting Principles in the United States Accounting principles as set forth in the statements of the Financial Accounting Standards Board and related guidance, which are applicable in the circumstances as of the date in question. Gross premiums written Total premiums for insurance written and assumed reinsurance during a given period. Incurred but not reported; IBNR Reserves for estimated losses that have been incurred by insureds and reinsureds but not yet reported to the insurer or reinsurer, including unknown future developments on losses that are known to the insurer or reinsurer. Insurance-linked securities Financial instruments whose values are driven by (re)insurance loss events. Our investments in insurance-linked securities are generally linked to property losses due to natural catastrophes. International Financial Reporting Standards Accounting principles, standards and interpretations as set forth in opinions of the International Accounting Standards Board which are applicable in the circumstances as of the date in question. Layer The interval between the retention or attachment point and the maximum limit of indemnity for which a reinsurer is responsible. Line The amount of excess of loss reinsurance protection provided to an insurer or another reinsurer, often referred to as limit. Line of business The general classification of insurance written by insurers and reinsurers, e.g. , fire, allied lines, homeowners and surety, among others. Lloyd’s Depending on the context, this term may refer to (a) the society of individual and corporate underwriting members that insure and reinsure risks as members of one or more syndicates (i.e., Lloyd’s is not an insurance company); (b) the underwriting room in the Lloyd’s building in which managing agents underwrite insurance and reinsurance on behalf of their syndicate members (in this sense Lloyd’s should be understood as a market place); or (c) the Corporation of Lloyd’s which regulates and provides support services to the Lloyd’s market. Loss; losses An occurrence that is the basis for submission and/or payment of a claim. Whether losses are covered, limited or excluded from coverage is dependent on the terms of the policy. Loss reserve For an individual loss, an estimate of the amount the insurer expects to pay for the reported claim. For total losses, estimates of expected payments for reported and unreported claims. These may include amounts for claims expenses. Managing agent An underwriting agent which has permission from Lloyd’s to manage a syndicate and carry on underwriting and other functions for a member. Net claims and claim expenses The expenses of settling claims, net of recoveries, including legal and other fees and the portion of general expenses allocated to claim settlement costs (also known as claim adjustment expenses or loss adjustment expenses) plus losses incurred with respect to net claims. Net claims and claim expense ratio Net claims and claim expenses incurred expressed as a percentage of net earned premiums. Net premiums earned The portion of net premiums written during or prior to a given period that was actually recognized as income during such period. 35

2021 Annual Report Page 50 Page 52

2021 Annual Report Page 50 Page 52