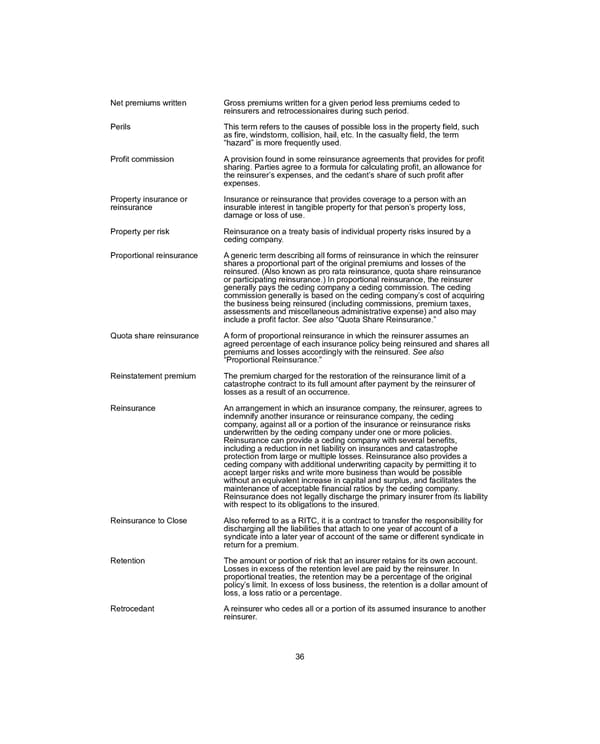

Net premiums written Gross premiums written for a given period less premiums ceded to reinsurers and retrocessionaires during such period. Perils This term refers to the causes of possible loss in the property field, such as fire, windstorm, collision, hail, etc. In the casualty field, the term “hazard” is more frequently used. Profit commission A provision found in some reinsurance agreements that provides for profit sharing. Parties agree to a formula for calculating profit, an allowance for the reinsurer’s expenses, and the cedant’s share of such profit after expenses. Property insurance or reinsurance Insurance or reinsurance that provides coverage to a person with an insurable interest in tangible property for that person’s property loss, damage or loss of use. Property per risk Reinsurance on a treaty basis of individual property risks insured by a ceding company. Proportional reinsurance A generic term describing all forms of reinsurance in which the reinsurer shares a proportional part of the original premiums and losses of the reinsured. (Also known as pro rata reinsurance, quota share reinsurance or participating reinsurance.) In proportional reinsurance, the reinsurer generally pays the ceding company a ceding commission. The ceding commission generally is based on the ceding company’s cost of acquiring the business being reinsured (including commissions, premium taxes, assessments and miscellaneous administrative expense) and also may include a profit factor. See also “Quota Share Reinsurance.” Quota share reinsurance A form of proportional reinsurance in which the reinsurer assumes an agreed percentage of each insurance policy being reinsured and shares all premiums and losses accordingly with the reinsured. See also “Proportional Reinsurance.” Reinstatement premium The premium charged for the restoration of the reinsurance limit of a catastrophe contract to its full amount after payment by the reinsurer of losses as a result of an occurrence. Reinsurance An arrangement in which an insurance company, the reinsurer, agrees to indemnify another insurance or reinsurance company, the ceding company, against all or a portion of the insurance or reinsurance risks underwritten by the ceding company under one or more policies. Reinsurance can provide a ceding company with several benefits, including a reduction in net liability on insurances and catastrophe protection from large or multiple losses. Reinsurance also provides a ceding company with additional underwriting capacity by permitting it to accept larger risks and write more business than would be possible without an equivalent increase in capital and surplus, and facilitates the maintenance of acceptable financial ratios by the ceding company. Reinsurance does not legally discharge the primary insurer from its liability with respect to its obligations to the insured. Reinsurance to Close Also referred to as a RITC, it is a contract to transfer the responsibility for discharging all the liabilities that attach to one year of account of a syndicate into a later year of account of the same or different syndicate in return for a premium. Retention The amount or portion of risk that an insurer retains for its own account. Losses in excess of the retention level are paid by the reinsurer. In proportional treaties, the retention may be a percentage of the original policy’s limit. In excess of loss business, the retention is a dollar amount of loss, a loss ratio or a percentage. Retrocedant A reinsurer who cedes all or a portion of its assumed insurance to another reinsurer. 36

2021 Annual Report Page 51 Page 53

2021 Annual Report Page 51 Page 53